How reliable is LIC's claim of least amount of mis-selling complaints?

LIC acquired 2.4 mis-promoting proceedings according to 10,000 rules in April-September 2021. Over the years, a plethora of instances in which vendors throughout existing coverage organizations mis-bought such merchandise to unsuspecting, gullible policyholders have come to light. For years, economic planners have advised retail buyers in opposition to shopping for existing coverage-cum-funding rules, because of better commissions, charges, and steep go-out barriers. State-owned Life Insurance Corporation of India’s (LIC) centre merchandise – conventional endowment plans – has regularly been criticized for its opaque rate shape and better give-up costs. Over the years, a plethora of instances in which vendors throughout existing coverage organizations are bought such merchandise to unsuspecting, gullible policyholders have come to light.

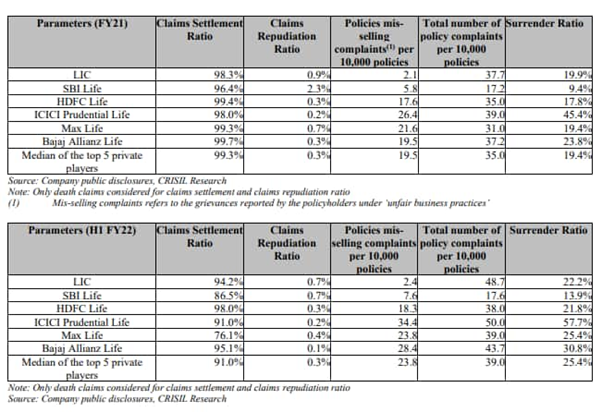

However, the records on policyholders’ proceedings, positioned out through LIC’s draft crimson herring prospectus beforehand of its mega IPO, indicate that the coverage colossus obtained among the bottom is-promoting proceedings withinside the industry. LIC obtained 2.4 is-promoting proceedings according to 10,000 regulations in April-September 2021, in comparison to SBI Life’s 7.6. Other existing insurers fared plenty worse, with ICICI Prudential Life Insurance obtaining 34.4 is-promoting proceedings according to 10,000 regulations, Bajaj Allianz Life 28.4, Max Life 23.8 and HDFC Life 18.3. For monetary year 2020-21, LIC had stated even higher figures with 2.1 mis-promoting proceedings according to 10,000 regulations. Complaints obtained beneath the ‘Unfair commercial enterprise practices’ are classified as mis-promoting proceedings.

Mis-selling menace continuesBut industry-watchers aren't satisfied with approximately the low proportion of mis-promoting complaints. “How many humans truly examine the coverage documents? Many do now no longer even understand that they've been mis-bought guidelines till they mature. And via way of means of then, it's far too late. All along, it’s been smooth to promote financial savings plans because the economic literacy tiers in India were low. It will now no longer be smooth to promote guidelines with excessive commissions and give up expenses to younger, financially-savvy people in future,” says an economic guide who did now no longer want to be recognized as he became related to a few existing coverage majors withinside the past.

The mis-promoting threat has plagued the existing coverage quarter for a long, with man or woman dealers in addition to distributor financial institution officers being accused of pushing wrong existing coverage regulations. Complex product systems made it hard for impressionable clients to decipher the workings. “There isn't any let-up in mis-promoting court cases in our experience. We have encountered instances wherein regulations intended for more youthful clients being bought to older individuals,” says purchaser activist Jehangir Gai. Mortality charges – the price of the existence cowl embedded in such regulations - are related to age, which devours into returns, denting older individuals’ adulthood corpus. Earlier, many dealers befell long-time period existence coverage regulations as an unmarried top class or short-time period ones. Policyholders regularly found those capabilities best after receiving renewal notices withinside the next years. Savings and funding regulations are regularly bought through policyholders in a rush at some point of the once-a-year tax-saving season (January-February-March) best to assert tax blessings of as much as Rs 1.5 lakh beneath neath segment 80C.

Despite the Insurance Regulatory and Development Authority of India’s (IRDAI) rules to diminish mis-selling, cap commissions as additionally mechanisms that existing coverage groups have installed in place, the risk persists. A low persistency ratio – or excessive lapsation fee – is a key fallout from such malpractices, as policyholders drop out after they comprehend the unsuitability. In the case of LIC, one-1/3 policyholders surrender on their rules the year after purchase, whilst fifty-two percent accomplish that after the 5th year (61st month), as in line with IRDAI’s manual on Indian insurance information for the monetary year 2020-21. Here, persistency information is in phrases of a wide variety of rules. The private sector, too, fares poorly in this count, with thirteenth and 61st persistency ratios of sixty-nine percent and forty-one percent respectively. That is, 31 percent of the policyholders pick out to allow pass in their rules after a year and fifty-nine percent accomplish that after the 5 years. This, regardless of the reality that existence coverage rules are supposed to be long-time period merchandise with tenures of over 7-10 years. To be sure, the industry's persistency ratios as of September 30, 2021, on the idea of rates are better. LIC recorded a 61st-month persistency ratio of 60.6 percent, whilst different pinnacle 5 private gamers suggested persistency ratios of 45.3 - 52.3 percent at some point of the period. Yet, the retention fee is low thinking that existing coverage rules have long-time period top rate price phrases.

Other complaints higher than peersLIC, even though, has now no longer been capable of reflecting this overall performance in phrases of typical court cases, which usually consist of coverage processing, servicing, declare processing, and so on. Under this head, LIC obtained 48.7 court cases consistent with 10,000 policies, subsequent most effective to ICICI Prudential Life’s 50 as of September 30, 2021. The public region giant’s declared agreement ratio, commonly the very best withinside the industry, dipped to 94.2 percent in April-September 2021, a decrease from that of HDFC Life (ninety-eight percent) and Bajaj Allianz Life (95.1 percentage), and even though agreement of pending claims through the cease of the economic 12 months should push it up later. In FY 2020-21, it had settled 98.3 percent of the loss of life claims obtained, rejecting 0.9 percent of the claims. Death claims discuss the quantity paid out to the policyholder’s dependents in case of her loss of life.

To know more about How reliable is LIC's claim of least amount of mis-selling complaints?, kindly contact Jayant Harde on 9373284136 or +91 7122282029. You can also visit our website: www.jayantharde.com

Comments

Post a Comment