LIC Agent in Nagpur

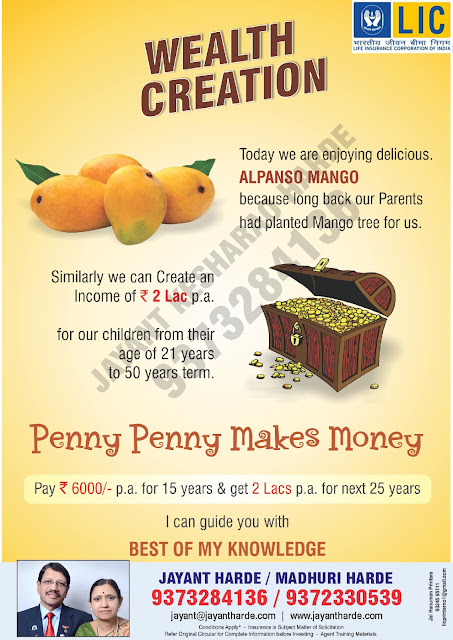

Wealth Creation :

It’s usually misunderstood that life insurance is only meant for protection, but be warned, it is also cost-effective for wealth creation. Life Insurance products play the following role in wealth creation:

- Protection on the savings/investment: Life insurance products cover risks in the event of death, critical illness or accident in the savings products. When a person decides to create wealth through a life insurance plan, he/she buys a cover on the savings that has the effect of paying out the amount he/she is not able to save due to the happening of the insured event (death, critical illness or accident).

- Regular savings: Life insurance premium have to be paid regularly and on time. Once a person commits to wealth creation through a life insurance plan, he/she commits to regular payments that has the effect of paying oneself first and helps in wealth creation.

- Availability of emergency fund: Most life insurance plans in the wealth creation category offer policy loans or allow withdrawals after the initial years. The loans are available at reasonable rate of interest and procedure for availing the loan is simple. This has the effect of making available funds in the event of an emergency.

- Protection of assets: Life insurance savings contracts offer riders such as term rider, critical illness benefit rider, accident benefit rider, which provide additional protection over and above the inbuilt protection of the savings. The money paid out on the rider in the event of an eventuality can help protect the asset created by the plan and help in the process of wealth creation.

Comments

Post a Comment