How reliable is LIC's claim of least amount of mis-selling complaints?

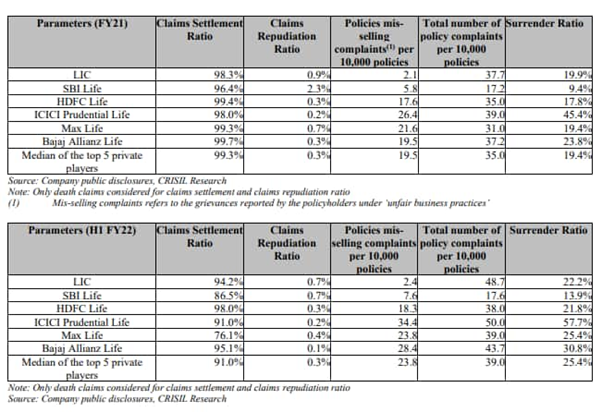

LIC acquired 2.4 mis-promoting proceedings according to 10,000 rules in April-September 2021. Over the years, a plethora of instances in which vendors throughout existing coverage organizations mis-bought such merchandise to unsuspecting, gullible policyholders have come to light. For years, economic planners have advised retail buyers in opposition to shopping for existing coverage-cum-funding rules, because of better commissions, charges, and steep go-out barriers. State-owned Life Insurance Corporation of India’s (LIC) centre merchandise – conventional endowment plans – has regularly been criticized for its opaque rate shape and better give-up costs. Over the years, a plethora of instances in which vendors throughout existing coverage organizations are bought such merchandise to unsuspecting, gullible policyholders have come to light. However, the records on policyholders’ proceedings, positioned out through LIC’s draft crimson herring prospectus beforehand of its mega IPO, indic...